Market rallied today but SMA 120 acted as resistance. Overall indexes moved around 2% down this week. However, starting with yesterday afternoon market rallied no less than 25 points!

The intermediary time frame bearish momentum is in a very great danger, any move on the upside on Monday is going to cancel it. Honestly, I didn't see any reason why market rallied today. The pullback it's supposedly due Libya's riots and to the price of oil. From what I red today the situation in Libya it's getting worse. Saudi Arabia promised to increase the oil production to compensate for whatever is lost in Libya. This indeed is a good news but the oil jumped 1% today. Wasn't that supposed to be bad for stocks?

But let's forget about this oil drama and concentrate on the biggest news that hit the market today, GDP was revised down from 3.2% to 2.8%. This is a huge revision, no less than 14%. Why did the market celebrate this news? Bite me! On the other hand I must admit reading fundamental news is not my strong point so I guess those who bought today know something I am not aware of or I don't understand. That's why I stick with technical analysis, I buy when the market goes up and I go short when it goes down without being concerned WHY market is moving up or down.

So, the good news for bulls is that SPX couldn't push above SMA 120. DOW, the other index for which this pair of EMAs and SMA are working is also bellow SMA 120. So there is some hope that market is going to stay bearish next week but the market action starts to resemble November's dip and not a real move on the downside. When the move is real price stays bellow SMA 120 for a few good weeks after the sell signal is generated. The only noticeable exception I have in mind is the April-June 2010 plunge when market went up and down SMA 120 for a few days before plunging to fresh lows.

Since September market was incredible bullish and every move on the downside was short lived and not really profitable on intermediate time frame. Keep this in mind and don't get too comfortable on the short side.

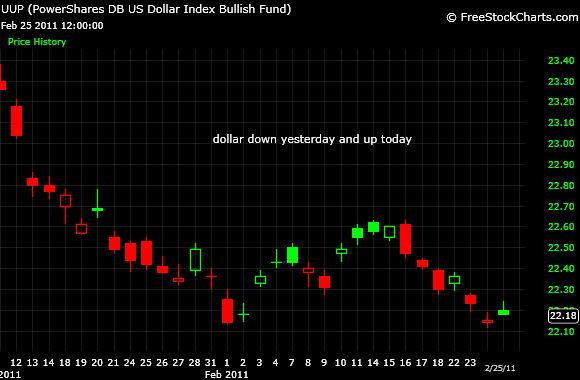

I told you yesterday that VIX did not behave, it went down with the market instead being a contrarian indicator as usual. This shows a lot of nervosity and uncertainty in the market. Even more, dollar and precious metals went up or down in tandem for the second day in a row.

Since EMAs shows a bearish crossing and price is just a little bit bellow SMA 120 I am still hanging on my shorts but once again I have my finger on the "cover" button on Monday.

The intermediary time frame bearish momentum is in a very great danger, any move on the upside on Monday is going to cancel it. Honestly, I didn't see any reason why market rallied today. The pullback it's supposedly due Libya's riots and to the price of oil. From what I red today the situation in Libya it's getting worse. Saudi Arabia promised to increase the oil production to compensate for whatever is lost in Libya. This indeed is a good news but the oil jumped 1% today. Wasn't that supposed to be bad for stocks?

But let's forget about this oil drama and concentrate on the biggest news that hit the market today, GDP was revised down from 3.2% to 2.8%. This is a huge revision, no less than 14%. Why did the market celebrate this news? Bite me! On the other hand I must admit reading fundamental news is not my strong point so I guess those who bought today know something I am not aware of or I don't understand. That's why I stick with technical analysis, I buy when the market goes up and I go short when it goes down without being concerned WHY market is moving up or down.

So, the good news for bulls is that SPX couldn't push above SMA 120. DOW, the other index for which this pair of EMAs and SMA are working is also bellow SMA 120. So there is some hope that market is going to stay bearish next week but the market action starts to resemble November's dip and not a real move on the downside. When the move is real price stays bellow SMA 120 for a few good weeks after the sell signal is generated. The only noticeable exception I have in mind is the April-June 2010 plunge when market went up and down SMA 120 for a few days before plunging to fresh lows.

Since September market was incredible bullish and every move on the downside was short lived and not really profitable on intermediate time frame. Keep this in mind and don't get too comfortable on the short side.

I told you yesterday that VIX did not behave, it went down with the market instead being a contrarian indicator as usual. This shows a lot of nervosity and uncertainty in the market. Even more, dollar and precious metals went up or down in tandem for the second day in a row.

Since EMAs shows a bearish crossing and price is just a little bit bellow SMA 120 I am still hanging on my shorts but once again I have my finger on the "cover" button on Monday.

No comments:

Post a Comment

Thank you for your feed-back