Neither bulls nor bears seem to be too comfortable at this point. Bulls seem out of steam, bears were too hurt recently to have enough confidence to try something. 1130 still holds and hourly chart still shows a nice EMAs crossing but DMI has turned negative today. The same happened on the last wave on the upside, back in August, SPX reached 1130, then we had a week were market moved up and down just a little bit, followed by a big drop to 1040. It may not happen this time but bulls should be cautious at this point.

The uptrend line on daily chart is around 1065, it moves very slowly which is good since a slow uptrend line is much more sustainable than a steep one. SMA50 continues to rise but also SMA200 has recently started to rise which is good for the long term time frame since a declining SMA200 spells big trouble. If this rally is going to be for real we should see a "golden cross" soon, SMA50 moving above SMA200. SMA50 moved above SMA100 recently, for the first time since June when we did saw a bearish crossing. EMA50 also moved above EMA100

What should we expect next? As usual I don't try to outguess the market but rather try to react to its moves. Saying that, the intermediate time frame bulls should keep a close eye on EMAs crossing on 60 minute chart and sell if they see a bearish crossing. Long term bulls should watch SMA200 (1117) or at least 1100 level. DMI holds clues regarding the momentum. What I am watching for a long time is DMI on weekly chart. If the weekly DMI turns positive SPX most likely is going to climb above the previous high around 1220. Once again, let's not anticipate what market is going to do, that is a losing game. "Trend is your friend"

babaro

Wednesday, September 29, 2010

Friday, September 24, 2010

Is this rally for real?

Are we finally getting out of the trading range for good? This is the 4th week in a row on the upside. Honestly, after yesterday trading day, I didn't think bulls would manage this performance but they did. DMI turned positive on 60 minutes chart and once again price moved above both EMA25 and EMA50. Even more encouraging we do have a new high on daily chart.

As for resistance levels, we do have the January high around 1150and the May high around 1170. On weekly chart the January peak is around 1145 and there is nothing in between this level and the April high. The only bearish sign on weekly chart is the DMI that turned negative in May and stayed this way since.

However, there is something I don't like, is the negative divergence I am seeing in MACD (there is none on EW histogram). While the market is making new highs, MACD histogram does not keep the pace and as you can see we do have actually a downtrend line.

babaro

As for resistance levels, we do have the January high around 1150and the May high around 1170. On weekly chart the January peak is around 1145 and there is nothing in between this level and the April high. The only bearish sign on weekly chart is the DMI that turned negative in May and stayed this way since.

However, there is something I don't like, is the negative divergence I am seeing in MACD (there is none on EW histogram). While the market is making new highs, MACD histogram does not keep the pace and as you can see we do have actually a downtrend line.

babaro

Thursday, September 23, 2010

Bellow 1130

Momentum is fading on short term as evidenced by the hourly DMI that turned red today for the first time in the last 3 weeks. Also the price slipped bellow EMA50 but we still have a bullish EMAs crossing and price is still above the rising five days SMA. Weekly, we are a bit on red so unless tomorrow market moves up we are not going to see gains for four weeks in a row.

As I mentioned yesterday bulls should be happy if they manage to defend SMA200 or at least 1100 level. The more volume they manage to accumulate above 1100-1115 the better.

babaro

As I mentioned yesterday bulls should be happy if they manage to defend SMA200 or at least 1100 level. The more volume they manage to accumulate above 1100-1115 the better.

babaro

Wednesday, September 22, 2010

Bulls taking a break

No significant technical change in the last two days. Bulls pushed SPX to 1148 yesterday then gave up 14 points by the end of today. A pretty big drop but without consequences at the technical level. We still have a bullish EMAs crossing and DMI is still positive on hourly chart. The only minor event was the price slipping bellow EMA25. This is not a big deal, price can even move bellow EMA50 without triggering a bearish EMAs crossing but I am mentioning this to you because this is the first time it did happen since September 1st.

On daily chart I see DMI still looking good and, of course, there is a slow uptrend line that barely managed to climb to 1060. This may prove to be a good support level in the future. Of course bulls don't want to hear about 1060 again and they may argue that there are many other good support levels in between such as SMA200 (1116) or 1100.

On weekly chart the uptrend line is around 1090 so we may need to keep an eye on this one as well. The only problem with the weekly uptrend line is that is too steep and it may not be sustainable. Also notice that the DMI made some good progress and moved up to May's level but it's still negative. Two resistance levels here, one around 1135 and the other one around 1145. If we finish the week above any of this level is going to look good for bulls.

What should we expect next? The fact that market cleared the 1130 level is very encouraging but you should keep in mind that once a resistance level is conquered that level does not automatically transform into a support level. For the sake of the bullish long term picture I hope market is going to find a good support above SMA200. It won't be a tragedy if it's going to slip a bit bellow SMA200 but finds support at the most important level of all, 1100.

All the best!

babaro

On daily chart I see DMI still looking good and, of course, there is a slow uptrend line that barely managed to climb to 1060. This may prove to be a good support level in the future. Of course bulls don't want to hear about 1060 again and they may argue that there are many other good support levels in between such as SMA200 (1116) or 1100.

On weekly chart the uptrend line is around 1090 so we may need to keep an eye on this one as well. The only problem with the weekly uptrend line is that is too steep and it may not be sustainable. Also notice that the DMI made some good progress and moved up to May's level but it's still negative. Two resistance levels here, one around 1135 and the other one around 1145. If we finish the week above any of this level is going to look good for bulls.

What should we expect next? The fact that market cleared the 1130 level is very encouraging but you should keep in mind that once a resistance level is conquered that level does not automatically transform into a support level. For the sake of the bullish long term picture I hope market is going to find a good support above SMA200. It won't be a tragedy if it's going to slip a bit bellow SMA200 but finds support at the most important level of all, 1100.

All the best!

babaro

Monday, September 20, 2010

Major resistance level overcomed

SPX finally managed to climb above 1130, so no triple top. This must please bulls that are waiting for this moment for a while. Daily DMI looks good, last time it looked so bullish was in March. Of course the hourly chart looks very good with EMAs crossing around 1080 and DMI on green.

Not too much resistance ahead since the move on the downside was violent now we have a huge gap and gaps tend to get filled pretty fast. This is particularly true if one looks on the weekly charts. On daily charts we have the January peak around 1150 and a small one around 1170 formed one the sharp rebound we had after the May 6 scary day.

Really conservative players should probably wait for weekly DMI to turn positive. It's not there yet but in the last few trading days it did made some good progress. Overall the picture turned bullish and we should expect bulls to push indexes further up.

As I mentioned a few times in the past the market action since March 2009 resembles that of 2004. However, the leg down after 14 month of continued rise looks more bearish this time around. Back then we also had SPX bellow SMA200 but SMA100 did not cross EMA200. This doesn't have any particular meaning, just an observation. The most important thing is that long term EMAs did not give a bearish cross during this recent leg down (it's not that I care since I am making money on either direction but for the sake of the argument).

babaro

Not too much resistance ahead since the move on the downside was violent now we have a huge gap and gaps tend to get filled pretty fast. This is particularly true if one looks on the weekly charts. On daily charts we have the January peak around 1150 and a small one around 1170 formed one the sharp rebound we had after the May 6 scary day.

Really conservative players should probably wait for weekly DMI to turn positive. It's not there yet but in the last few trading days it did made some good progress. Overall the picture turned bullish and we should expect bulls to push indexes further up.

As I mentioned a few times in the past the market action since March 2009 resembles that of 2004. However, the leg down after 14 month of continued rise looks more bearish this time around. Back then we also had SPX bellow SMA200 but SMA100 did not cross EMA200. This doesn't have any particular meaning, just an observation. The most important thing is that long term EMAs did not give a bearish cross during this recent leg down (it's not that I care since I am making money on either direction but for the sake of the argument).

babaro

Friday, September 17, 2010

Third up week in a row

Bulls can't complain too much, they have managed to push SPX up for the third week in a row, a performance not seen since April.

Daily DMI looks good and price did not even go bellow EMA25 on 60 minutes chart. All of this is bullish. Yet, I can't help noticing that price bumped into 1130 today, then went down as it did a couple more time this week. Without a rise above 1130 level we will see another mini-plunge since a triple top at 1130 is not going to be bullish. I hope the uptrend line (1060) is going to resist in the event the market will move down

babaro

Daily DMI looks good and price did not even go bellow EMA25 on 60 minutes chart. All of this is bullish. Yet, I can't help noticing that price bumped into 1130 today, then went down as it did a couple more time this week. Without a rise above 1130 level we will see another mini-plunge since a triple top at 1130 is not going to be bullish. I hope the uptrend line (1060) is going to resist in the event the market will move down

babaro

Thursday, September 16, 2010

Resistance at 1130

Not too much change for the third day in a row, daily and hourly DMI still positive, no bearish EMAs crossing and price above EMA25 on hourly chart.

No reason to panic but bulls seem to lose confidence, again, around the same level it happen twice in the recent past. A triple top at 1130 is not going to look very bullish on any time frame. We need to see SPX climbing above 1130 or at least a weekly close above 1121, the weekly level where bulls were stopped in August. Tomorrow is the expiration week Friday, a day that ended a little bit in red YTD (we'll see about that).

babaro

No reason to panic but bulls seem to lose confidence, again, around the same level it happen twice in the recent past. A triple top at 1130 is not going to look very bullish on any time frame. We need to see SPX climbing above 1130 or at least a weekly close above 1121, the weekly level where bulls were stopped in August. Tomorrow is the expiration week Friday, a day that ended a little bit in red YTD (we'll see about that).

babaro

Wednesday, September 15, 2010

The big question

Very little change in the last two days. Bulls are getting nervous since we are approaching the 1130 level that stopped them twice in a row.

The big question on everybody's lips is "are we finally going to get out of the trading range"? Let's wait to see if SPX manages to close above 1130 this week. 1130 was touched twice intra-day, once in June and once in August. However, the August high was a little bit higher than June's high on daily chart.

The most bullish chart in terms of establishing higher highs is on a longer time frame, on weekly charts. There you can see that we are already above the August peak. Of course the week has two more days to go but a potential close around 1130 is going to be 9 points above the 1121 weekly close on August.

You can see a small resistance level around 1135 and another one around 1145. After that is just a huge gap, gaps that tend to fill pretty fast. Also notice that both the uptrend and the downtrend lines are steeper on weekly chart than on daily one that makes the weekly chart looking more bullish than the daily one. A nice buy signal for long term players (assuming they are out of the market) is going to be a positive DMI on weekly chart but I don't see any sign that DMI is going to turn positive on this time frame any time soon.

The big question on everybody's lips is "are we finally going to get out of the trading range"? Let's wait to see if SPX manages to close above 1130 this week. 1130 was touched twice intra-day, once in June and once in August. However, the August high was a little bit higher than June's high on daily chart.

The most bullish chart in terms of establishing higher highs is on a longer time frame, on weekly charts. There you can see that we are already above the August peak. Of course the week has two more days to go but a potential close around 1130 is going to be 9 points above the 1121 weekly close on August.

You can see a small resistance level around 1135 and another one around 1145. After that is just a huge gap, gaps that tend to fill pretty fast. Also notice that both the uptrend and the downtrend lines are steeper on weekly chart than on daily one that makes the weekly chart looking more bullish than the daily one. A nice buy signal for long term players (assuming they are out of the market) is going to be a positive DMI on weekly chart but I don't see any sign that DMI is going to turn positive on this time frame any time soon.

Monday, September 13, 2010

Above SMA200

SPX moved just a little above a well watched level, SMA200. This is the third attempt to claim this level. The last two times SPX went above SMA200 it lasted only a few days. We are now slightly above June's high but bellow August's high. Even if market decides to go down again it's important to close above 1128 so we can have a higher high.

Daily DMI is positive, not by much but it's in green.

babaro

Daily DMI is positive, not by much but it's in green.

babaro

Friday, September 10, 2010

Another bullish week

Second bullish week in a row with SPX slightly clearing two resistance levels, 1105 and the downtrend line (today around 1100). DMI remains slightly positive but I would like to see the green line clearly above the red one.

On long term I won't consider the major leg down over unless DMI on weekly chart turns positive. It did turn negative at the beginning of May and never changed back to green. Notice that the downtrend line on weekly chart is around 1092. Also notice that SMA75, the moving average that was the support for both 1990-2000 and 2003-2007 bull markets, resides around 1057, the same place where we can find the current uptrend line so we have a double support level at this level.

Not too much change on 60 minutes chart either, the "buy" signal generated around 1080 remains intact and the price is above a rising 5 days SMA.

Let's see if SPX is going to challenge SMA200 (around 1115) on Monday or is going to pull down a little bit towards the downtrend line before trying to climb further up.

Have a nice week-end!

babaro

On long term I won't consider the major leg down over unless DMI on weekly chart turns positive. It did turn negative at the beginning of May and never changed back to green. Notice that the downtrend line on weekly chart is around 1092. Also notice that SMA75, the moving average that was the support for both 1990-2000 and 2003-2007 bull markets, resides around 1057, the same place where we can find the current uptrend line so we have a double support level at this level.

Not too much change on 60 minutes chart either, the "buy" signal generated around 1080 remains intact and the price is above a rising 5 days SMA.

Let's see if SPX is going to challenge SMA200 (around 1115) on Monday or is going to pull down a little bit towards the downtrend line before trying to climb further up.

Have a nice week-end!

babaro

Thursday, September 9, 2010

1105 resistance level holds

SPX moved just a little bit above the downtrend line (around 1102) but remains bellow the 1105 resistance level. DMI is slightly positive but refuses to make a decisive move indicating that market players are neither bullish nor bearish at this point but wait for some fundamental news before deciding what way to go.

We do have now an uptrend line somewhere around 1060 and a major downtrend line around 1102. Besides these obvious support/resistance levels we can expect a good support around 1070 and not less than three resistance levels 1105, 115 (SMA200) and 1130 (the most recent major high)

babaro

We do have now an uptrend line somewhere around 1060 and a major downtrend line around 1102. Besides these obvious support/resistance levels we can expect a good support around 1070 and not less than three resistance levels 1105, 115 (SMA200) and 1130 (the most recent major high)

babaro

Wednesday, September 8, 2010

Bellow downtrend line

SPX recovered some of the yesterday's losses but remains bellow the downtrend line and bellow the 1105 resistance level. Daily DMI remains slightly positive indicating that the momentum is rather neutral right now.

One of this blog readers made a comment regarding my "buy/sell" signals based on EMAs crossing and made me aware that if one back-test the EMAs crossing on 60 minutes chart the system produces losses over time (he went back to 2006). I really appreciate his/her comments, you should never blindly trust anybody, especially when you are using your hard earned money, you should always have questions about what other people are saying even if they are well-known gurus, not to mention a blogger like me.

It is possible that I've got lucky with this pair of EMAs (25 and 50 on hourly chart) in the last couple of years? Yes, it is possible to lose money with these EMAs if the market is extremely choppy and if it has extremely sharp moves up or down. In these cases both the buy and the sell signals are coming too late. Trading is about flexibility, if I see I am getting whip-sawed too many times I am going to go to longer time frames, if I see the buy and sell signals are coming too late I am going to shorter time frames. I do this kind of switch from time to time but I keep coming back to EMA25 crossing EMA50 on 60 minutes chart (or EMA50/EMA100 on 30 minutes chart). Of course EMAs crossing is not the only thing I am watching, I also look at support/resistance levels, DMI and uptrend/downtrend lines.

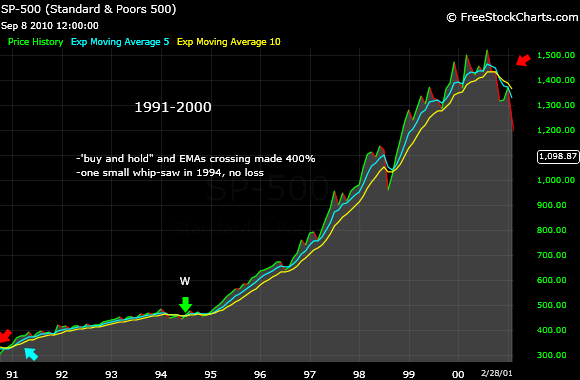

The second comment my reader made was that EMAs crossing doesn't work in general. I do agree that EMA25/EMA50 may not be the best pair of EMAs but I disagree that EMAs never work. I mentioned many times that I am using EMA100 crossing EMA200 as a tool to spot bull or bear markets. Long term players can use them as a "buy/sell" signal but they are actually too slow for this purpose. I had the curiosity, for the first time, to look way back in the past to see how good their signals were. Look at the charts bellow and judge for yourself if EMAs crossing works or not. I know it's hard to believe that a simple system like this can beat sophisticated computer programs or prophecies made by gurus you see daily on TV.

I can't look on daily charts for longer than two years or on weekly charts longer than the last 10 years so I had to look on monthly charts. The problem is that 100/200 days EMA results in EMA 5 crossing EMA 10 on monthly chart, two moving average hard to follow visually. Even if this pair of EMAs are too slow to actually generate good "buy/sell" signals you will notice that their performance in the last 40 years was pretty impressive.

First let's have a look at 1971-1981. EMAs crossing made 91%, "buy and hold" made 40%

1981-1991, "buy and hold" worked better, EMAs had two losses, one during 1987 crash and the other during 1991 crash. Both were too short lived to make them profitable by going short when the sell signal was generated.

1991-2000, both "buy and hold" and EMAs crossing made 400%. Wow! A minor whip-saw in 1994 generated a "buy" and a "sell" virtually at the same level.

2000-2003, "buy and hold" crew got crashed for the first time in years. EMAs crossing made a lot of money. 2003-2007, both "buy and hold" and EMAs made the same amount of money.

2007-2009, "buy and hold" lost 27%, EMAs crossing made 34%.

Except for 1981-1991 period EMAs crossing was net superior, especially in the last 10 years when not only kept players out two terrible bear markets but generated huge profits on the short side. After looking at these data I can confidently conclude that EMAs crossing is a valuable tool. It all depends on finding the right pair of EMAs and there is no other way than looking in the past and see what worked back then. One should keep an open mind and realize that the past does not predict the future but the past is a good starting point. Finding the right time frame is another issue. Less experienced players should consider longer time frames. I am not good enough to do day trading, not even day-to-day trading. I do feel comfortable with intermediate time frames, those that give buy/sell signals on 60 minutes chart. My reader may be right and maybe I've got lucky with EMA25/50 so I'll keep an eye on this pair to see if is going to perform well in the near future.

All the best!

babaro

One of this blog readers made a comment regarding my "buy/sell" signals based on EMAs crossing and made me aware that if one back-test the EMAs crossing on 60 minutes chart the system produces losses over time (he went back to 2006). I really appreciate his/her comments, you should never blindly trust anybody, especially when you are using your hard earned money, you should always have questions about what other people are saying even if they are well-known gurus, not to mention a blogger like me.

It is possible that I've got lucky with this pair of EMAs (25 and 50 on hourly chart) in the last couple of years? Yes, it is possible to lose money with these EMAs if the market is extremely choppy and if it has extremely sharp moves up or down. In these cases both the buy and the sell signals are coming too late. Trading is about flexibility, if I see I am getting whip-sawed too many times I am going to go to longer time frames, if I see the buy and sell signals are coming too late I am going to shorter time frames. I do this kind of switch from time to time but I keep coming back to EMA25 crossing EMA50 on 60 minutes chart (or EMA50/EMA100 on 30 minutes chart). Of course EMAs crossing is not the only thing I am watching, I also look at support/resistance levels, DMI and uptrend/downtrend lines.

The second comment my reader made was that EMAs crossing doesn't work in general. I do agree that EMA25/EMA50 may not be the best pair of EMAs but I disagree that EMAs never work. I mentioned many times that I am using EMA100 crossing EMA200 as a tool to spot bull or bear markets. Long term players can use them as a "buy/sell" signal but they are actually too slow for this purpose. I had the curiosity, for the first time, to look way back in the past to see how good their signals were. Look at the charts bellow and judge for yourself if EMAs crossing works or not. I know it's hard to believe that a simple system like this can beat sophisticated computer programs or prophecies made by gurus you see daily on TV.

I can't look on daily charts for longer than two years or on weekly charts longer than the last 10 years so I had to look on monthly charts. The problem is that 100/200 days EMA results in EMA 5 crossing EMA 10 on monthly chart, two moving average hard to follow visually. Even if this pair of EMAs are too slow to actually generate good "buy/sell" signals you will notice that their performance in the last 40 years was pretty impressive.

First let's have a look at 1971-1981. EMAs crossing made 91%, "buy and hold" made 40%

1981-1991, "buy and hold" worked better, EMAs had two losses, one during 1987 crash and the other during 1991 crash. Both were too short lived to make them profitable by going short when the sell signal was generated.

1991-2000, both "buy and hold" and EMAs crossing made 400%. Wow! A minor whip-saw in 1994 generated a "buy" and a "sell" virtually at the same level.

2000-2003, "buy and hold" crew got crashed for the first time in years. EMAs crossing made a lot of money. 2003-2007, both "buy and hold" and EMAs made the same amount of money.

2007-2009, "buy and hold" lost 27%, EMAs crossing made 34%.

Except for 1981-1991 period EMAs crossing was net superior, especially in the last 10 years when not only kept players out two terrible bear markets but generated huge profits on the short side. After looking at these data I can confidently conclude that EMAs crossing is a valuable tool. It all depends on finding the right pair of EMAs and there is no other way than looking in the past and see what worked back then. One should keep an open mind and realize that the past does not predict the future but the past is a good starting point. Finding the right time frame is another issue. Less experienced players should consider longer time frames. I am not good enough to do day trading, not even day-to-day trading. I do feel comfortable with intermediate time frames, those that give buy/sell signals on 60 minutes chart. My reader may be right and maybe I've got lucky with EMA25/50 so I'll keep an eye on this pair to see if is going to perform well in the near future.

All the best!

babaro

Tuesday, September 7, 2010

Bounce down

As I said on Friday I did expect a move down from the downtrend line (1105) that also coincided with a very good resistance level that gave bulls a lot of headaches in the recent past or at least a lateral consolidation before moving further up. That's exactly what happened today, SPX lost 13 points but we don't have too many changes at the technical level, we still have a bullish EMAs crossing on 60 minutes chart, a rising 5 days moving average and daily DMI remains slightly green. This week SPX may get trapped in between the downtrend line around 1105 and the uptrend line around 1055. On the downside we should keep an eye on 1070, a good support level according to "volume at price" . On the upside the most obvious resistance levels are 1105, 1115 (SMA200) and 1130, the most recent higher high.

babaro

babaro

Friday, September 3, 2010

Daily DMI turned slightly positive!

The buy signal generated two days ago was confirmed yesterday and today. Even better daily DMI turned slightly positive. We may see another attempt to conquer 1130, a level that "killed" the bulls for two times in the last 3 months. Otherwise, a triple top is going to be formed, something that is not going to be good for the perma-bulls.

Notice that the price stopped exactly at the major downtrend line, 1105. This is a major resistance level and I personally do expect a small pullback from here or at least some lateral consolidation before going further up. However, if SPX goes above 1105 the next stop should be around 1115 where the SMA200 resides and also one of the top three levels where we did see a lot of volume since the beginning of the leg down according to "volume at price" indicator (look two posts bellow)

Now let's have a look back at my preferred timing strategy, EMA25 crossing EMA50 on 60 minutes chart to see what was its performance since April 26 when the new leg down has started. For those of you who didn't follow my blog from the very beginning try one of the June's posts to see previous "buy/sell" signals. Since I am looking at hourly charts the software doesn't allow me to look further than 3 months back.

Most of the time when a sell signal is generated I sell my longs and immediately go short. If other indicators give me a "sell" signal before EMAs crossing I take profit on part of my shares (at least 25%), for example when daily DMI turned negative at the end of the April I took some profit around 1200 and sold the remaining shares around 1180 when EMAs did cross. Also when I recently spotted the "rising wedge" I took some profit. For the sake of the argument I am going to assume I did sell all my shares when I've got a bearish EMAs crossing and went 100% short at the same level.

short at 1180, cover at 1080

long at 1080, sell at 1090

short at 1090, cover at 1065

long at 1065, sell at 1095

short at 1100, cover at 1080

long at 1080, sell at ... (we'll see)

Excluding the last leg up since is not finished yet my strategy made me 185 points on SPX or if you prefer 1,900 points on DOW. It's not too much, I am sure there are people who made more money than me but I am trying to point out a strategy that can make you money no matter if the market is going up or down and with little risk. With discipline one can easily make 400-600 points per year on SPX depending on market conditions. Notice that I missed all the temporary tops and bottoms. Once again, notice the little risk I took to get these points, I never fought the market and at any point I wasn't in danger to lose my shirt.

All the best!

babaro

P.S. Once again thank you very much for all of you who did click on the adds displayed on this page, this is one way you can say "thank you" for the effort and time I am spending writing these daily analysis.

Notice that the price stopped exactly at the major downtrend line, 1105. This is a major resistance level and I personally do expect a small pullback from here or at least some lateral consolidation before going further up. However, if SPX goes above 1105 the next stop should be around 1115 where the SMA200 resides and also one of the top three levels where we did see a lot of volume since the beginning of the leg down according to "volume at price" indicator (look two posts bellow)

Now let's have a look back at my preferred timing strategy, EMA25 crossing EMA50 on 60 minutes chart to see what was its performance since April 26 when the new leg down has started. For those of you who didn't follow my blog from the very beginning try one of the June's posts to see previous "buy/sell" signals. Since I am looking at hourly charts the software doesn't allow me to look further than 3 months back.

Most of the time when a sell signal is generated I sell my longs and immediately go short. If other indicators give me a "sell" signal before EMAs crossing I take profit on part of my shares (at least 25%), for example when daily DMI turned negative at the end of the April I took some profit around 1200 and sold the remaining shares around 1180 when EMAs did cross. Also when I recently spotted the "rising wedge" I took some profit. For the sake of the argument I am going to assume I did sell all my shares when I've got a bearish EMAs crossing and went 100% short at the same level.

short at 1180, cover at 1080

long at 1080, sell at 1090

short at 1090, cover at 1065

long at 1065, sell at 1095

short at 1100, cover at 1080

long at 1080, sell at ... (we'll see)

Excluding the last leg up since is not finished yet my strategy made me 185 points on SPX or if you prefer 1,900 points on DOW. It's not too much, I am sure there are people who made more money than me but I am trying to point out a strategy that can make you money no matter if the market is going up or down and with little risk. With discipline one can easily make 400-600 points per year on SPX depending on market conditions. Notice that I missed all the temporary tops and bottoms. Once again, notice the little risk I took to get these points, I never fought the market and at any point I wasn't in danger to lose my shirt.

All the best!

babaro

P.S. Once again thank you very much for all of you who did click on the adds displayed on this page, this is one way you can say "thank you" for the effort and time I am spending writing these daily analysis.

"Buy" signal confirmed

We had the confirmation today that a new wave on the upside is taking place (EMA25 crossed EMA50 on 60 minutes chart).

Daily DMI is also looking good, still on red but with today move up (as the future indicate) it may move into the positive territory. We do have now a multi-month uptrend line around 1055 and a multi-months downtrend line around 1105 that also coincides with a very important resistance level. I do expect SPX to stay between these two lines next week. Of course a break on the upside (above 1105) is going to be bullish with the next potential resistance levels around 1115 (SMA200, and good volume according to "volume at price") and 1130, a level where two big upside waves got killed in the recent past.

babaro

Daily DMI is also looking good, still on red but with today move up (as the future indicate) it may move into the positive territory. We do have now a multi-month uptrend line around 1055 and a multi-months downtrend line around 1105 that also coincides with a very important resistance level. I do expect SPX to stay between these two lines next week. Of course a break on the upside (above 1105) is going to be bullish with the next potential resistance levels around 1115 (SMA200, and good volume according to "volume at price") and 1130, a level where two big upside waves got killed in the recent past.

babaro

Wednesday, September 1, 2010

Bulls fight back

A weak BUY signal was generated today after no less than 30 points on the upside but the "buy" signal needs confirmation tomorrow. Also notice that price slightly climbed above a declining 5 days moving average.

More important, on long term, is that price did not cross SMA75 on weekly chart and also that EMA20 did not cross EMA40, two events that defined the 2003-2007 bull market. Now we are back in the 1070-1100 trading range.

Let's now have a look at "volume at price" on April26-September1 time frame. 1070 is still the most important level, followed by 1115 and 1090. At 1070 bears were a little bit more in control so we should expect this level to act more as support than resistance. The other two levels were pretty equal, neither bulls nor the bears were in control. On longer time frame 1100 is by far the most important level in terms of volume.

If the "buy" signal is going to be confirmed today it is likely that another mini-rally will follow.

babaro

More important, on long term, is that price did not cross SMA75 on weekly chart and also that EMA20 did not cross EMA40, two events that defined the 2003-2007 bull market. Now we are back in the 1070-1100 trading range.

Let's now have a look at "volume at price" on April26-September1 time frame. 1070 is still the most important level, followed by 1115 and 1090. At 1070 bears were a little bit more in control so we should expect this level to act more as support than resistance. The other two levels were pretty equal, neither bulls nor the bears were in control. On longer time frame 1100 is by far the most important level in terms of volume.

If the "buy" signal is going to be confirmed today it is likely that another mini-rally will follow.

babaro

Subscribe to:

Comments (Atom)