Market slipped well bellow 1,359 today but bulls managed to recover no less than 16 points by the end of the day. Yesterday we had pretty much the same scenario, futures heavily down in the morning just to see the day ending flat. This gives bulls some hope that market won't plunge further down or at least the damage is going to be minimal. On the other hand market moved slightly bellow the head and shoulder "neck" on daily chart which is a bad sign for bulls since, in general, once this "neck" is broken market continues to decline.

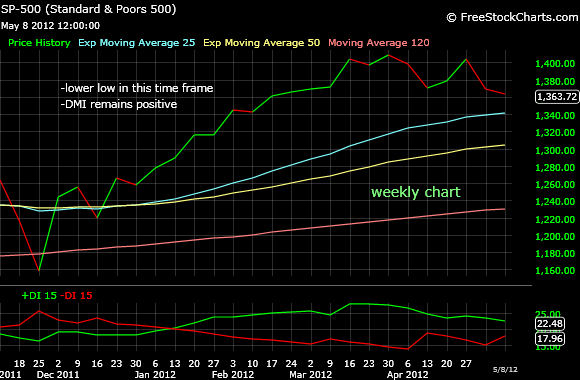

Weekly chart shown a fresh lower low but DMI remains positive on this time frame showing that the long term remains bullish.

With a dollar increasingly strong on European saga, gold is moving further down, today lost no less than 30 points. Technically, gold is at its worst moment in three years due to the "death cross" (the cross between SMA 50 and SMA 200). The strong 2009-2012 uptrend line was violated today, not by much but one should be at least a little bit concerned especially keeping in mind that both daily and weekly DMI are negative.

The major companies have reported their earnings so the only fundamental that influence the market are the news coming from Europe, especially Greece.

All the best!

babaro

Weekly chart shown a fresh lower low but DMI remains positive on this time frame showing that the long term remains bullish.

With a dollar increasingly strong on European saga, gold is moving further down, today lost no less than 30 points. Technically, gold is at its worst moment in three years due to the "death cross" (the cross between SMA 50 and SMA 200). The strong 2009-2012 uptrend line was violated today, not by much but one should be at least a little bit concerned especially keeping in mind that both daily and weekly DMI are negative.

The major companies have reported their earnings so the only fundamental that influence the market are the news coming from Europe, especially Greece.

All the best!

babaro

No comments:

Post a Comment

Thank you for your feed-back