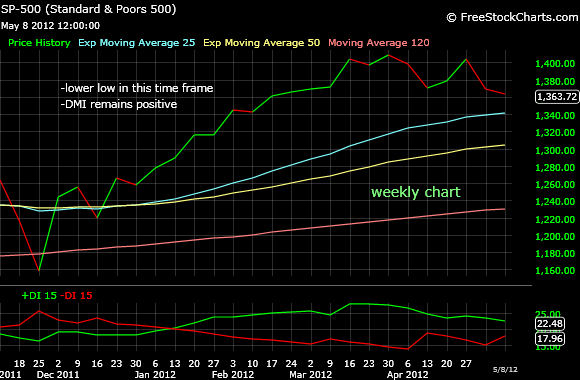

After three weeks on the downside finally bears took a break and let bulls push SPX 22 points above last Friday level. Looking at the hourly chart one can say that intermediate time frame is bearish to neutral, SPX is still bellow the declining SMA 120, EMAS show a bearish crossing but EMAs are not declining anymore, they are rather flat.

However, looking at daily and weekly charts, the 22 points jump this week doesn't look that impressive. I need to see higher lows and higher highs to be convinced that bulls are trying to do something but this pattern develops in time, one week not being enough. I can say I was pretty impressed by the reversal day I saw two days ago, SPX went down to 1,297 in the morning just to see it climbing up 20 points and finishing 3 points up. Unfortunately for the bulls I didn't see any follow up the next two days.

As I mentioned before I am watching the most obvious support levels, the head and shoulder drop prediction (1,290), SMA 200 (1,285) and bull market uptrend line (1,250). So far the 1,290 level was successfully defended but we may this level challenged again in the next few weeks. It all depends on the Greek saga.

Dollar rallied for the forth consecutive week and consequently oil, gold and silver went a down this week.

Have a nice Memorial Day weekend!

babaro